Since the maximum number of units that could possibly be completed is 8,700, the number of units in the shaping department’s ending inventory must be 1,200. The total of the 7,500 units completed and transferred out and the 1,200 units in ending inventory equal the 8,700 possible units in the shaping department. The next step is to convert the physical units in production shown above (10,000) into equivalent units.

Why You Can Trust Finance Strategists

The mixing department started another 3,250 shells during February, and at the end of the month, there were still 1,000 shells being mixed and prepped for baking. They were only 25% complete as to conversion but 100% of the direct materials had been added (because they are added at the beginning of the process). In this method, both the beginning and ending inventory is converted into equivalent units, so there is a bit more work to do. For those units that were in the beginning inventory, we need to figure out how much work was DONE on them in this period to get them to the point of being transferred to the next process. For those items in the ending inventory, it is the same as the weighted-average method, where we need to calculate how much work has been done to them already. Our equivalent units of production for the period is 1,200 units (700 + 500).

Step Four: Allocating the Costs to the Units Transferred Out and Partially Completed in the Shaping Department

We want to make sure that we have assigned all the costs from beginning work in process and costs incurred or added this period to units completed and transferred and ending work in process inventory. In the current period, we transferred 500 units to process 2, and have 350 equivalent units in our WIP inventory. Essentially saying, that process 1 completed 850 units to completion of process 1 in this period. Under FIFO, remember to bring over the costs of beginning work in process first, then multiply the individual equivalent units calculated in step 2 (not the total equivalent units) by the cost per equivalent unit from step 3.

- The reason why is because the figure of completed units alone is not an accurate measure of a department’s output since some of the department’s efforts during a period are expended on units that are only partially complete.

- Notice that by including the costs brought forward, 100% of the cost of producing the units in beginning WIP are included.

- The total materials costs for the period (including any beginning inventory costs) are computed and divided by the equivalent units for materials.

- In the weighted average method, we divided total costs by total Equivalent Units, but here is where the FIFO method is significantly different.

- As described previously, process costing can have more than one work in process account.

- The amount transferred out will include materials costs incurred during the current period plus any amount in beginning inventory.

Module 7: Costing Methods

So, if the factory had different costs for chocolate bars at different times, the Weighted-Average method would add up all the costs and divide by the total number of bars produced to get a single average cost per bar. This makes it easier to calculate costs when there are many different costs over a period. The equivalent production for each department is determined, which is later used to calculate the cost per unit of each job order by apportioning their total costs on basis of equivalent units.

Allocating the Cost of Production

This is called the Weighted Average method and there are other methods too (discussed below). Materials are added at the beginning of the process; conversion costs are added evenly throughout the process. For example, if the opening work-in-progress is 500 units, 40% complete in all respects, then the degree of work to be performed in the current accounting vs finance period is 60%. First, the equivalent production of opening work-in-progress should be determined by taking into account the degree of work to be performed in the current period. In circumstances where the product is flowing in batches like this, FIFO gives us a more accurate per unit cost for both beginning and ending work-in-process inventory.

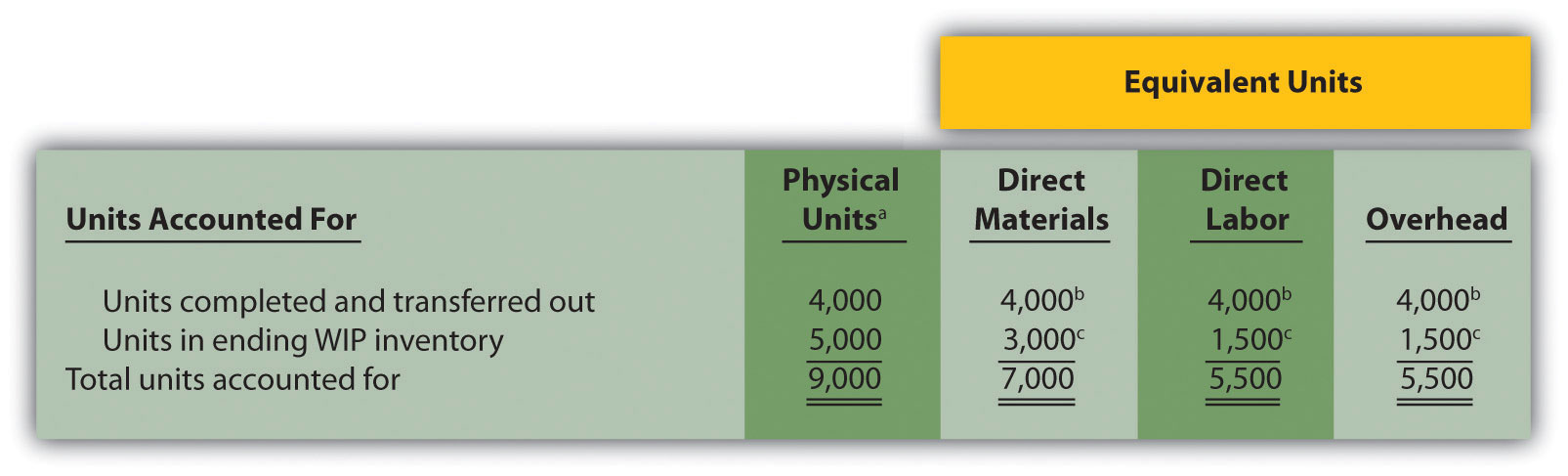

In Department B, the ending units may be in different stages of completion regarding the materials, labor, and overhead costs. Assume that Department B adds all materials at the beginning of the production process. Then ending inventory would be 100% complete as to materials since we received all materials at the beginning of the process. Units completed and transferred are finished units and will always be 100% complete for equivalent unit calculations for direct materials, direct labor and overhead. For units in ending work in process, we would take the units unfinished x a percent complete.

Accountants base this concept on the supposition that a company must incur approximately the same amount of costs to bring 1,000 units to a 40% level of completion as it would to complete 400 units. Weighted average takes the units completed during the period and adds it to your ending WIP. The equivalent unit cost of materials is, therefore, $1.31 ($118,000/90,000 EU).

One thing to keep in mind when using the weighted average method, we don’t need to compute the equivalent units for the ones transferred out. Those are considered 100% complete for the work done in that department, otherwise they wouldn’t be moving forward to the next process. These costs are then used to calculate the equivalent units and total production costs in a four-step process. The limitation of equivalent units computation is that it does not take into account the number of units completed in any specific unit. For example, let’s assume that a company manufactured 2000 motorcycles for this year and 30% of motorcycles were lost due to defects. If these defects are non recurring then such units should be excluded from equivalent production.