Also, because they repay debt quickly, these businesses will likely have solid credit, which allows them to borrow inexpensively from lenders. The depository industry (banks and lenders) may have high debt-to-equity ratios. Because banks borrow funds to loan money to consumers, financial institutions usually have higher debt-to-equity ratios than other industries. Using excel or another spreadsheet to calculate the D/E is relatively straightforward. First, using the company balance sheet, pull the total debt amount and the total shareholder equity amount, and enter these numbers into adjacent cells (e.g. E2 and E3). Current liabilities are the debts that a company will typically pay off within the year, including accounts payable.

What is considered a bad debt-to-equity ratio?

Tesla had total liabilities of $30,548,000 and total shareholders’ equity of $30,189,000. A D/E ratio of 1.5 would indicate that the company in question has $1.50 of debt for every $1 of equity. To illustrate, suppose the company had assets of $2 million and liabilities of $1.2 million. Because equity is equal to assets minus liabilities, the company’s equity would be $800,000. The debt-to-equity ratio is most useful when used to compare direct competitors.

What Does a Leverage Ratio Tell You?

The optimal debt-to-equity ratio will tend to vary widely by industry, but the general consensus is that it should not be above a level of 2.0. While some very large companies in fixed asset-heavy industries (such as mining or manufacturing) may have ratios higher than 2, these are the exception rather than the rule. This means that for every dollar of equity, Company A has two dollars of debt. This high ratio could indicate a high level of risk, depending on the industry and economic conditions. As a gauge of financial leverage, it provides a snapshot of a company’s financial stability and risk profile.

Is an increase in the debt-to-equity ratio bad?

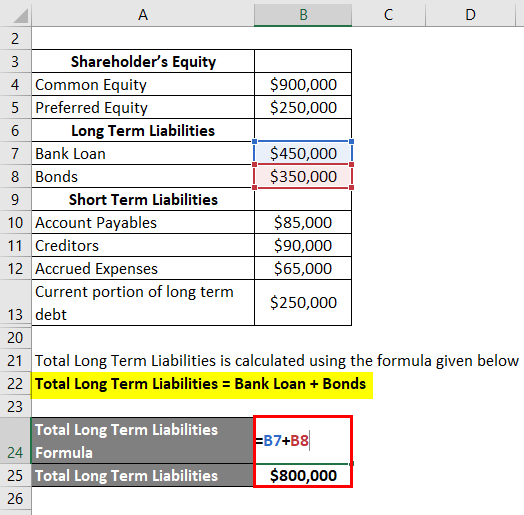

It can be used to measure how much capital comes in the form of debt (loans) or assess the ability of a company to meet its financial obligations. To calculate the D/E ratio, divide a firm’s total liabilities by its total shareholder equity—both items are found on a company’s balance sheet. The D/E ratio is a financial metric that measures the proportion of a company’s debt relative to its shareholder equity. The ratio offers insights into the company’s debt level, indicating whether it uses more debt or equity to run its operations.

- There are several metrics that are used to gauge the financial health of a company, how the company finances its business operations and assets, as well as its level of exposure to risk.

- In many cases, it involves dividing a company’s debt by something else, such as shareholders equity, total capital, or EBITDA.

- So in the case of deciding whether to invest in IPO stock, it’s important for investors to consider debt when deciding whether they want to buy IPO stock.

- He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Very high D/E ratios may eventually result in a loan default or bankruptcy. If a company has a negative D/E ratio, this means that it has negative shareholder equity. In most cases, this would be considered a sign of high risk and an incentive to seek bankruptcy protection. On the other hand, the typically steady preferred dividend, par value, and liquidation rights make preferred shares look more like debt. This ratio is used to evaluate a firm’s financial structure and how it is financing operations.

Ask a Financial Professional Any Question

The main factors considered are debt, equity, assets, and interest expenses. A company’s debt to equity ratio can also be used to gauge the financial risk of the company. A high debt to equity ratio means that a company is highly dependent on debt to finance its growth. Creditors generally like a low debt to equity ratio, because it ensures that the firm is not already heavily relying on debt which ultimately indicates a greater protection to their funds. A significantly low ratio may, however, also be found in companies that reluctant to take the advantage of debt financing for growth.

If interest rates are higher when the long-term debt comes due and needs to be refinanced, then interest expense will rise. To get a clearer picture and facilitate comparisons, analysts and investors will often modify the D/E ratio. They also assess the D/E ratio in the context of short-term leverage ratios, profitability, and growth expectations. This ratio indicates that the higher the degree of financial leverage, the more volatile earnings will be. Since interest is usually a fixed expense, leverage magnifies returns and EPS.

On the other hand, when a company sells equity, it gives up a portion of its ownership stake in the business. The investor will then participate in the company’s profits (or losses) and will expect to receive a return on their investment for as long as they hold the stock. Debt financing is often seen as less risky than equity financing because the company does not have to give up any ownership stake. A low D/E ratio shows a lower amount of financing by debt from lenders compared to the funding by equity from shareholders. An important part of investing and financial analysis lies in deciphering the health of a company’s balance sheet.

The long-term D/E ratio for Company A would be 0.8 vs. 0.6 for company B, indicating a higher risk level. For example, if a company, such as a manufacturer, requires a lot of capital to operate, it may need to take on a lot of debt to finance its operations. An increase in the D/E ratio can be a sign that a company is taking on too much debt and may not be able to generate the definition of net credit sales on a balance sheet chron com enough cash flow to cover its obligations. However, industries may have an increase in the D/E ratio due to the nature of their business. For example, capital-intensive companies such as utilities and manufacturers tend to have higher D/E ratios than other companies. The current ratio measures the capacity of a company to pay its short-term obligations in a year or less.

SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.